J Korean Acad Oral Health.

2022 Dec;46(4):192-206. 10.11149/jkaoh.2022.46.4.192.

Evaluation of the effectiveness of the policy to expand the scope of national health insurance dental scaling service benefits

- Affiliations

-

- 1School of Medicine/Graduate School of Public Health, Hanyang University, Seoul, Korea

- 2Department of Preventive Medicine, Hanyang University School of Medicine, Seoul, Korea

- KMID: 2537814

- DOI: http://doi.org/10.11149/jkaoh.2022.46.4.192

Abstract

Objectives

Korea’s National Health Insurance (NHI) coverage rate for dental services is 16.0%, far lower than the 33.0% average of OECD (Organization for Economic Co-operation and development) countries. In 2013, the government implemented a policy to pay for dental scaling service for adults over the age of 20. Then in 2017, the eligibility criteria was expanded to adults aged 19 or older the eligibility age was lowered expanded to 19 or older.

Methods

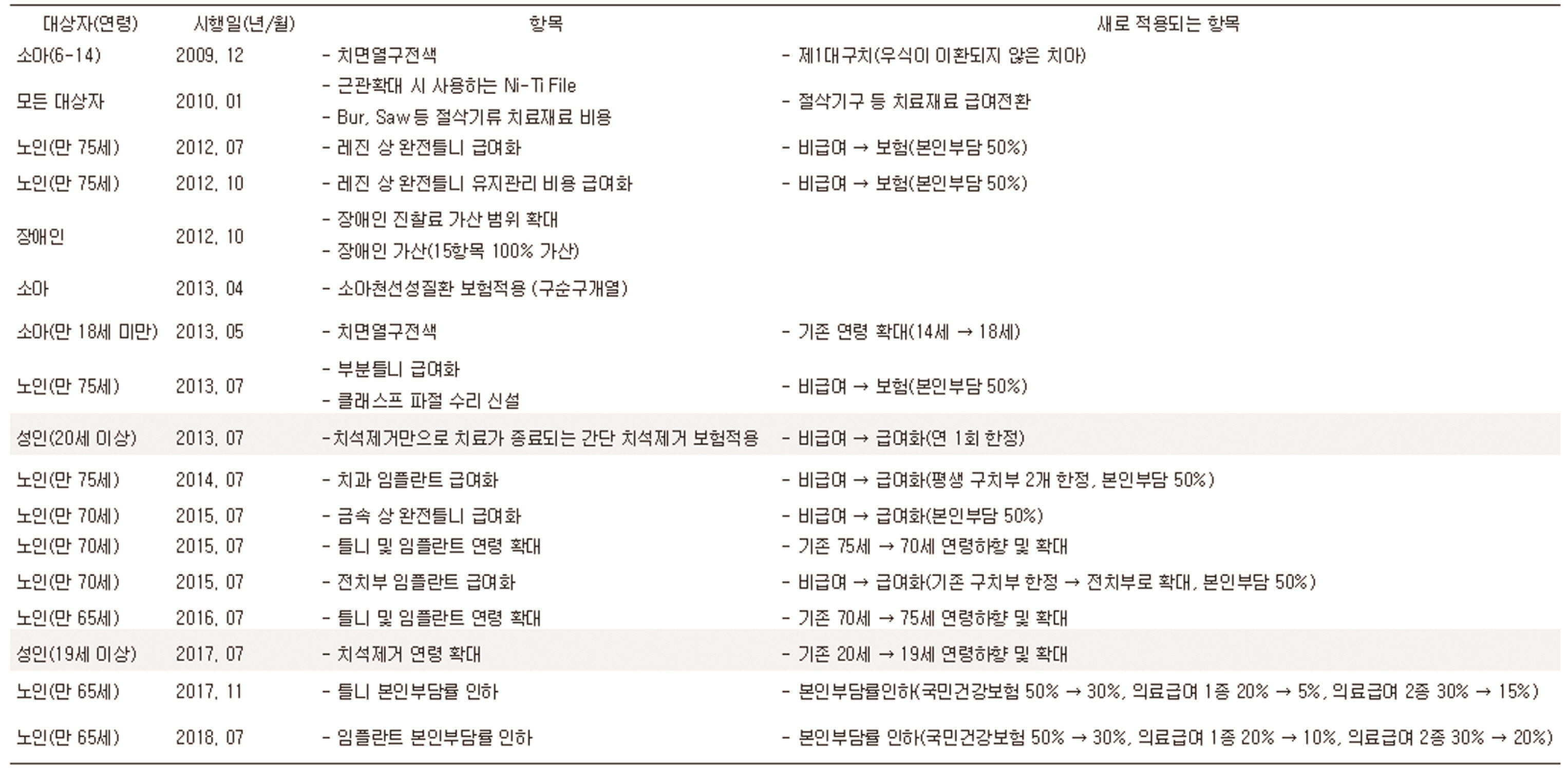

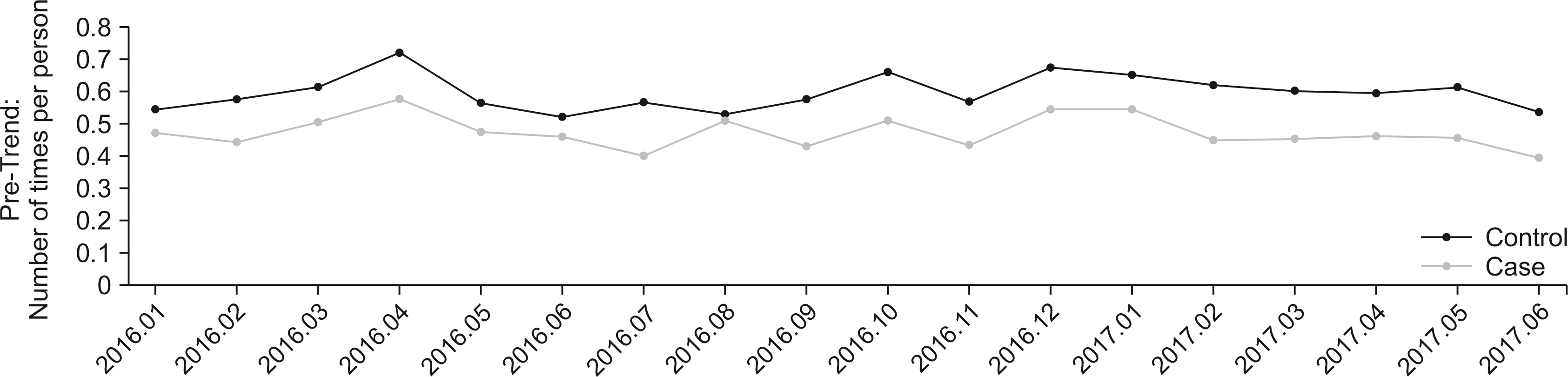

The study aimed to determine the effectiveness of the policy by comparing the number of times per person the dental scaling service was used before and after the implementation of the new applicants group compared to the existing application/applicants group. The analysis was conducted among patients aged 19 and 20 who visited the hospital with gingivitis and periodontal disease and who used the dental scaling service more than once per year as a preventive measure, using the customized database of the NHIC (National Health Insurance Corporation). As of July 1, 2017 when the dental scaling service was implemented by the National Health Insurance Service, the period was set as “before enforcement” (January 2016 to June 2017) and “after enforcement” (July 2017 to December 2018). To evaluate the policy effectiveness of expandingthe ages of individuals eligible for the dental scaling service, Difference-in-Differences (DiD) analysis was conducted to examine the number of times per person the service was used, changes in personal contributions, and policy effectiveness.

Results

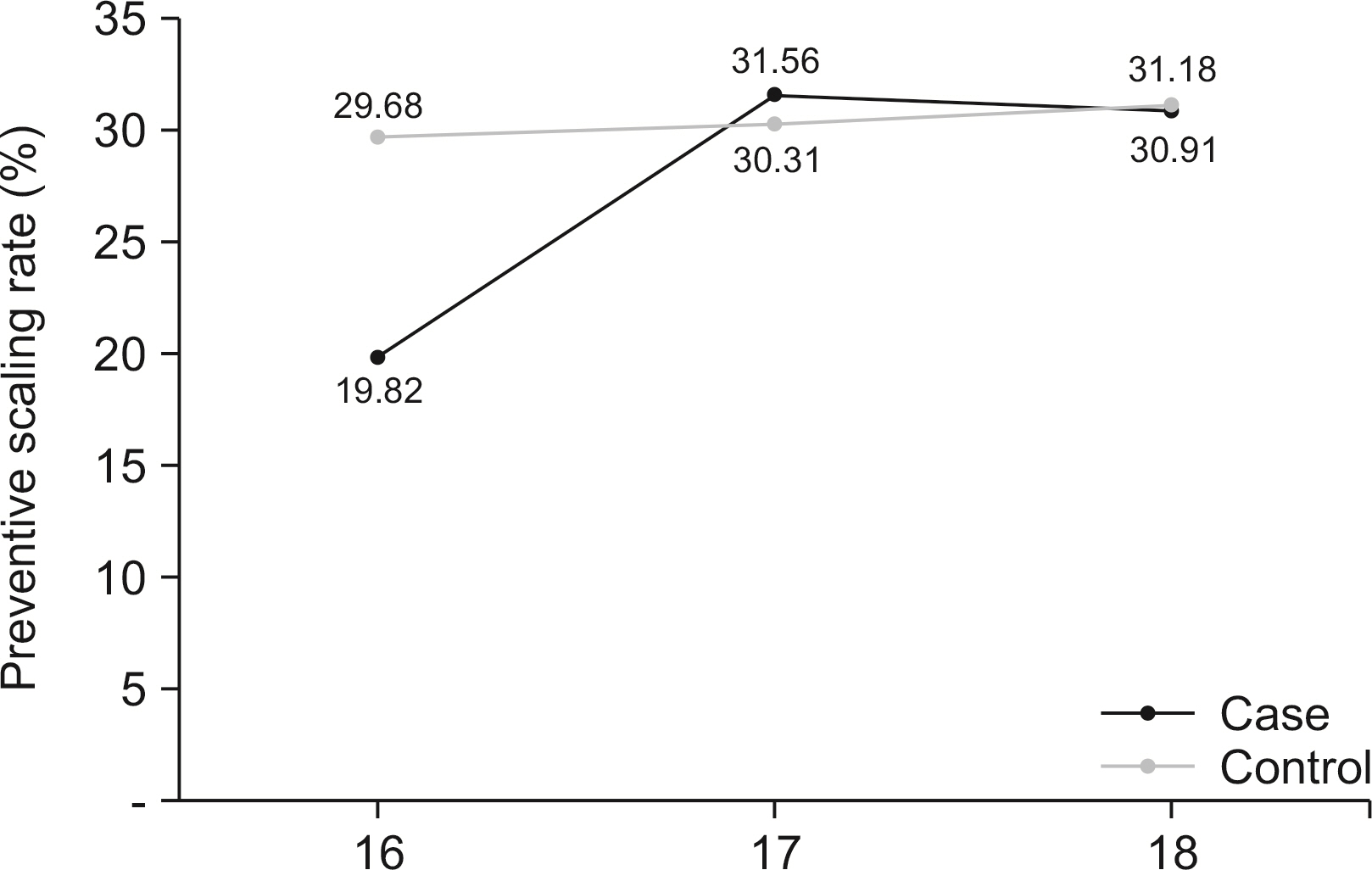

Since the National Health Insurance policy to pay for dental scaling services, both the applicants group and the sustainable application group have increased the rate of inspection of preventive dental scaling services (19.82%→30.91%, 29.68%→31.18%). As a result of determining the pure effect of the NHI’s policy of covering the dental scaling service, it was found that the the number of times the dental scaling service was used per person increased significantly in the new application group (0.03 times, <.0001).

Conclusions

However, it was found that the cost of the dental scaling service per person while the cost of the dental scaling decreased was shown to decrease, it was not statistical significant. Therefore, additional policy support such as lowering the personal financial burden is needed for those who are unable to afford the service.

Keyword

Figure

Reference

-

References

1. Kim Y. 2016; Strategies for strengthening the national health insurance coverage. Monthly Welfare Trends. (218):26–32.2. Kim YO, Shin YJ. 2017; The Effect of the Policy of Expanding Coverage for Four Major Diseases: Focused on Out-of-Pocket Payment. Health Soc Welf Rev. 37(2):452–476. DOI: 10.15709/hswr.2017.37.2.452.3. Kim DJ, Kim YA, Lee SH, Seo JH, Kim JH. 2016; The Effect of Increased Health Care Coverage on Provider Behavior in Cancer Care. Korea institute for health and social affairs. 1–252.4. Son YR. 2018; Policy Direction for Strengthening Health Insurance Coverage. HIRA Policy Trends. 12(1):7–18.5. Roh SY, Kim JS. 2008; The theoretical study of rational policy decision on the National Health Insurance's copayment. J Korean Public Policy. 10(2):149–174.6. Kim MH, Kwon SM. 2010; The Effect of Outpatient Cost Sharing on Health Care Utilization of the Elderly. J Prev Med Public Health. 43(6):496–504. http://doi.org/10.3961/jpmph.2010.43.6.496. DOI: 10.3961/jpmph.2010.43.6.496. PMID: 21139410.7. Yeo NG. 2020; Policy on Non-reimbursable Services in the National Health Insurance. Health and welfare policy forum. (11):23–37.8. Kang HD. 2020; History of the National Dental Health Insurance System - The Birth, Introduction, Integration, and Development of Medical Insurance. Journal of the Korean Academy of Dental Insurance. 10(1):6–20.9. National Health Insurance Review and Assessment Service. 2013. Standard Guide for Calculation of Disease and Behavior Statistics. p. 1–290.10. National Health Insurance Review and Assessment Service. 2013. Standard Guide for Calculation of Disease and Behavior Statistics. p. 1–306.11. Kim KO, Jeon YH, Shin YJ. 2018; Effect of Major Burn Coverage Reinforcement Policy on Out-of-pocket Payment. J Crit. Soc. Policy. (59):7–32. DOI: 10.47042/ACSW.2018.05.59.7.12. Chandra A, Gruber J, McKnight R. Patient cost-sharing, hospitalization offsets, and the design of optimal health insurance for the elderly. NBER. http://doi.org/10.3386/w12972. DOI: 10.3386/w12972.13. Choi BY, Lee HJ. Multilevel Analysis of Factors Related to Cost and Length of Stay in Acute Myocardial Infarction Patients with Coronary Stenting: Based on Korean National Health Insurance Service's Customized Database in 2010 and 2015. Health Policy Manag. 30(3):418–429. https://doi.org/10.4332/KJHPA.2020.30.3.418.14. Kim NY. 2019; Government Program Evaluation Using Difference-in-Differences: Employment and School Dropout effect of Mister School Program. Korean J. Policy Anal. 29(3):165–195.15. Kim S, Kwon S. 2015; Impact of the policy of expanding benefit coverage for cancer patients on catastrophic health expenditure across different income groups in South Korea. Soc Sci & Medicine. 138:241–247. DOI: 10.1016/j.socscimed.2015.06.012. PMID: 26123883.16. Kwon GH, Lee DK, Seo IS. 2014; An Analysis on the Relationship between Policies to Strengthen Healthcare Insurance Coverage and the Expenditure by Private Insurers: Application of the DID (differences in differences) analysis using data from Korea Medical Panel. GRI review. 16(2):265–293.17. Yoon JY, Hong MK. 2014; Effects of the Maternity Leave Policy on Female Employment. Quarterly Journal of Labor Policy. 14(4):31–57.18. Choi YJ. 2017; The Effect of the Fast-Track Corporate Rehabilitation Program on the ICR of the Companies Under Court Receivership. Bank of Korea WP. (20):https://ssrn.com/abstract=3090751. DOI: 10.2139/ssrn.3059316.19. Yun SH, Suh CJ. 2016; The effects of the scaling health insurance coverage expansion policy on the use of dental services among patients with gingivitis and periodontal disease. Korean J Health Econ Policy. 22(2):143–162.20. Huh JS, Nam SH, Lee BR, Hu KS, Jung IY, Choi SH, Lee JY. 2019; Improvement of accessibility to dental care due to expansion of national health insurance coverage for scaling in South Korea. J Kor Dent Assoc. 57(11):644–653.21. Son YN, Lee YJ, Nam CM, Kim GR, Ching WJ. 2020; Effect of Coverage Expansion Policy for an Ultrasonography in the Upper Abdomen on Its Utilization: A Difference-in-Difference Mixed-Effects Model Analysis. Health Policy Manag. 30(3):326–334. https://doi.org/10.4332/KJHPA.2020.30.3.326.22. Park SY, Kim HT, Suh HS. 2022; Cost-benefit analysis for expanding insurance coverage of dental scaling to adolescents in South Korea. Korean Econ Rev. 6(2):1–23.

- Full Text Links

- Actions

-

Cited

- CITED

-

- Close

- Share

- Similar articles

-

- International Comparison of the Non-benefits Management Policies for Public and Private Health Insurance

- Changes in dental care access upon health care benefit expansion to include scaling

- Awareness and satisfaction survey regarding national health insurance dental scaling

- Trends in the utilization of dental outpatient services affected by the expansion of health care benefits in South Korea to include scaling: a 6-year interrupted time-series study

- Association between oral health behaviors and dental scaling frequency: linked datasets from the National Health Insurance Service and the Korea National Health and Nutrition Examination Survey